Even for the companies that are present in the market. The advantages for SST are.

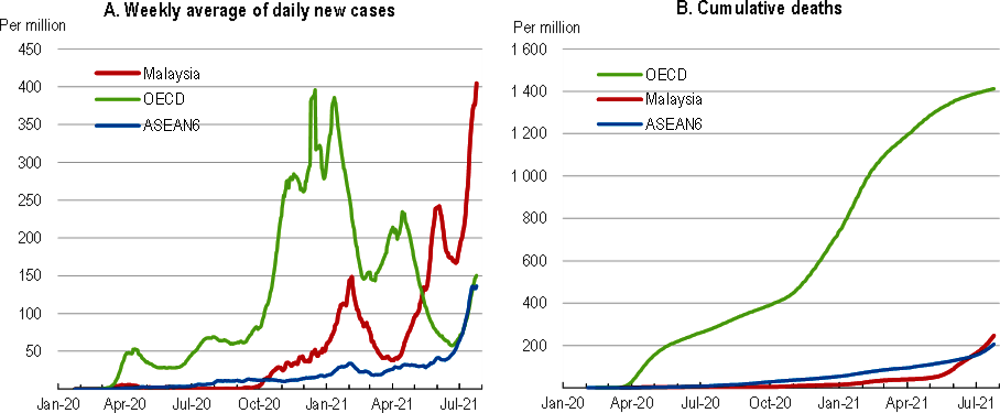

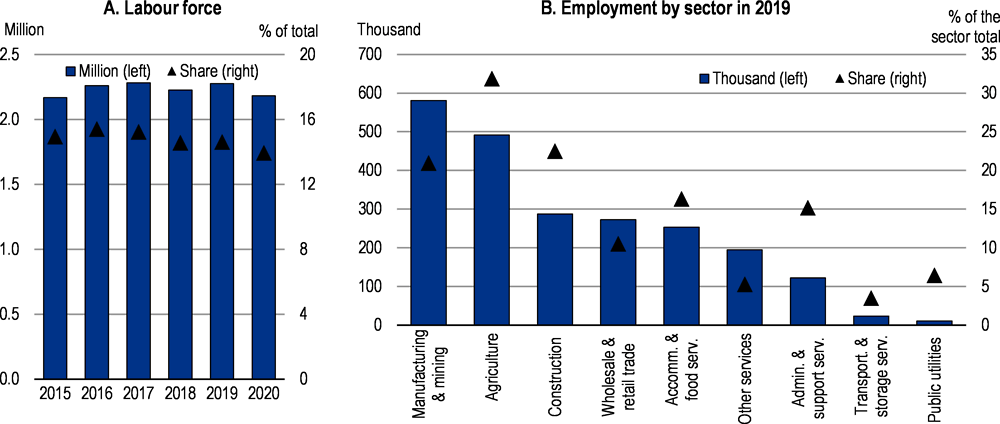

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Malaysias special designated areas - including Langkawi Island Tioman Island and Labuan Federal Territory - are exempt from the service tax.

. The Advantages of GST. For retailers GST will not be a cost incurred which means that there will be. Easy and Simple Registration Process.

SST is a simple and straightforward tax regime where businesses do not need to spend time and effort on calculating GST refunds. Currently stands at 325. Wholesalers and retailers will not be required to pay the 10 tax which means they will not be required to prepare tax submissions quarterly which is normally required under the GST law.

With the introduction of SST Malaysia enjoyed the advantage of a lower cost of living because the seller pays the sales tax at the point of sale only once. Goods and Services Tax GST GST covers everyone retailers and trades. One expected benefit from the SST is a lower cost of living as sales tax is charged just once by.

SST rates are less transparent than the GST which had a standard 6 rate the SST rates vary from 6 or 10. The SST exemption is for all passenger vehicles including MPVs and SUVs but does not include trucks that. Service tax a consumption tax levied and charged on any taxable services provided in Malaysia by a registered service provider in carrying out their.

Mohamad Hanapi who is also a member of the board of directors of Picoms International University College said the Pakatan Harapan governments thrust on transparency and integrity would also be a plus point for the. In the service tax no input exemption mechanism is. Rate could go up to 35 in the whole of 2019.

It is extended for another six months from 1 January to 30 June 2022 for new CKD and CBU cars. Compared to any other tax registration process GST registration in Malaysia can be done with ease. It stands for 10 percent for sales tax while service tax will be charged 6 percent according to the new release from the finance ministry.

One expected benefit from the SST is a lower cost of living as sales tax is charged just once by. In general there are 3 notable impacts the public and businesses will feel from the change of GST to SST in Malaysia. GST registration has been made online which makes it simpler for people who are doing company registration in Malaysia for the very first time.

Service Tax is charged on a specific service provided by a taxable person in Malaysia carrying out a business. View Advantages-of-SSTdocx from BUSINESS UH at INTI International University. Sales and service tax SST has been doing well in Malaysia before it was replaced a few years back.

It is a 10 single tax that is imposed on importers or factories. 1 Food and Beverage Retail Shop Clothing cosmetics and gadgets retail shops prices will be slightly lower around 3 from the savings of input costs. 2 New properties New houses are expected to experience a slightly cheaper price from reduced input costs.

Sales tax a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer and on taxable goods imported into Malaysia. If the authorities can oversee this matter effectively the SST will certainly bring more benefits than GST he explained. GST can help the diversification of income sources for the government instead of just relying on income tax and petroleum tax alone.

Sales and Services Tax SST The Sales Tax is only imposed on the manufacturer level the Service Tax is imposed on consumers that are using tax services. The 6 GST was introduced in Malaysia in 2015 and the SST is a lot similar to this system. Malaysia Automotive Institute MAI chief executive officer Datuk Madani Sahari said that SST implementation has indeed reduced car prices but mostly only cars produced in the country.

Sunday 12 Aug 2018. MALAYSIAs decision to revert to the Sales and Service Tax SST from the Goods and Services Tax GST will. Consumers pay 10 at factory.

There was a total exemption of 5443 items and only a few businesses are required to pay SST if compared to GST. It is a single stage tax imposed on factories or importer at 10. The SST consists of 2 elements.

Producers and service providers who are uncertain of their status pertaining to SST should take a closer look at the regulations for further information. The decision was made to encourage new car purchases which will drive the growth of the countrys automotive sector and the overall economy. The goods that get tax exemption from SST are ten times more compared to the GST.

Malaysias special designated areas - including Langkawi Island Tioman Island and Labuan Federal Territory - are exempt from the service tax. First lets take a look at the good things that the GST has brought forth since its inception in Malaysia. Therefore the wholesellers and retailers do not need to pay this tax no need to prepare quarterly tax submission as.

The Service tax is also a single-stage tax with a rate of 6. Advantages of SST SST bring several advantages to Malaysia and. Contribute to syahrulputrimelayusahh development by creating an account on GitHub.

Less Paperwork for Businesses. This tax is not required for imported or exported services. Sunway University Business School economics professor Dr Yeah Kim Leng said that the SST is a single stage tax and not being collected at every stage of the supply chain and.

Malaysia Is Your Ultimate Business Destination Eco Business Park V

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

Pdf The Status Of The Paddy And Rice Industry In Malaysia

Sales Service Tax Sst In Malaysia Acclime Malaysia

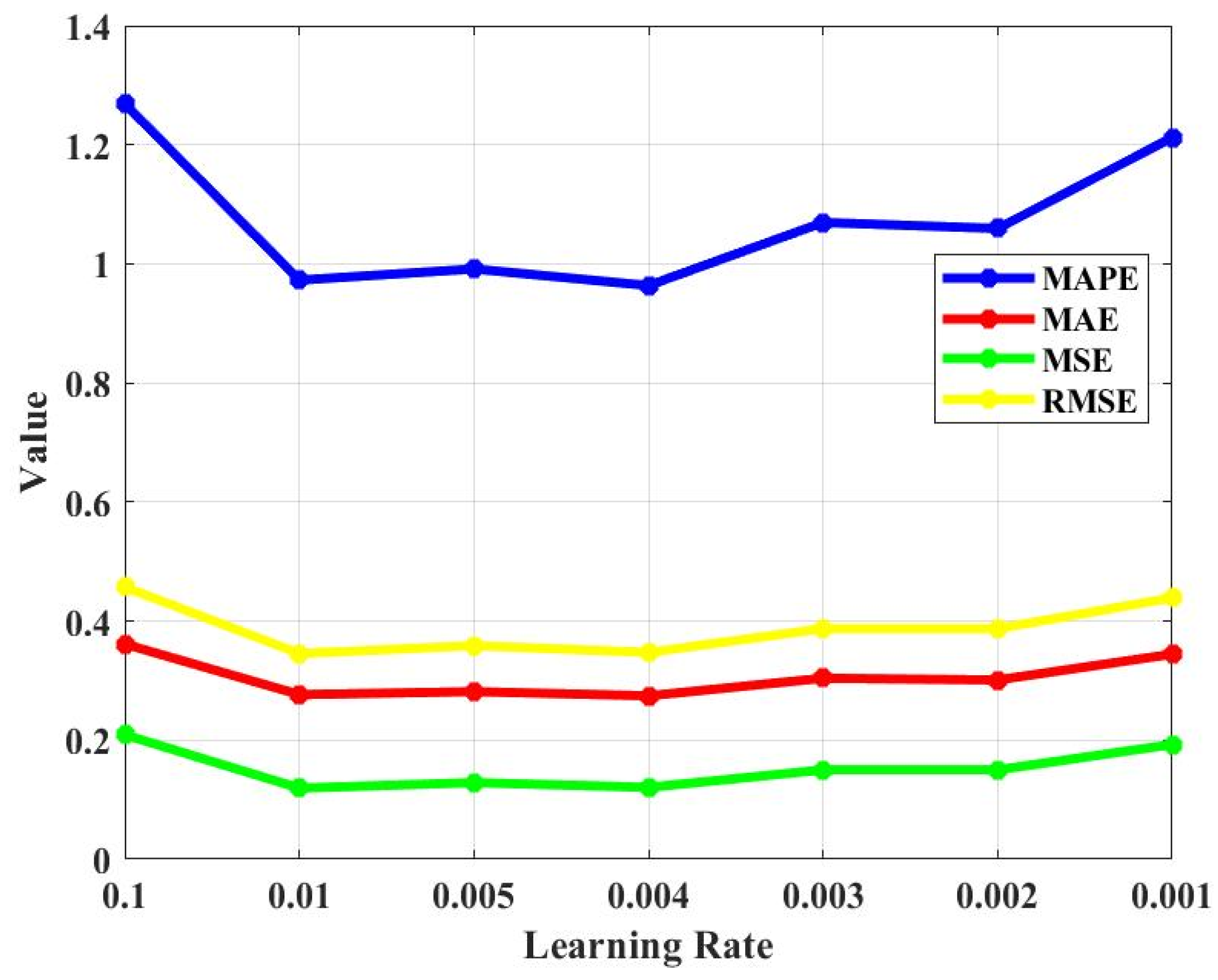

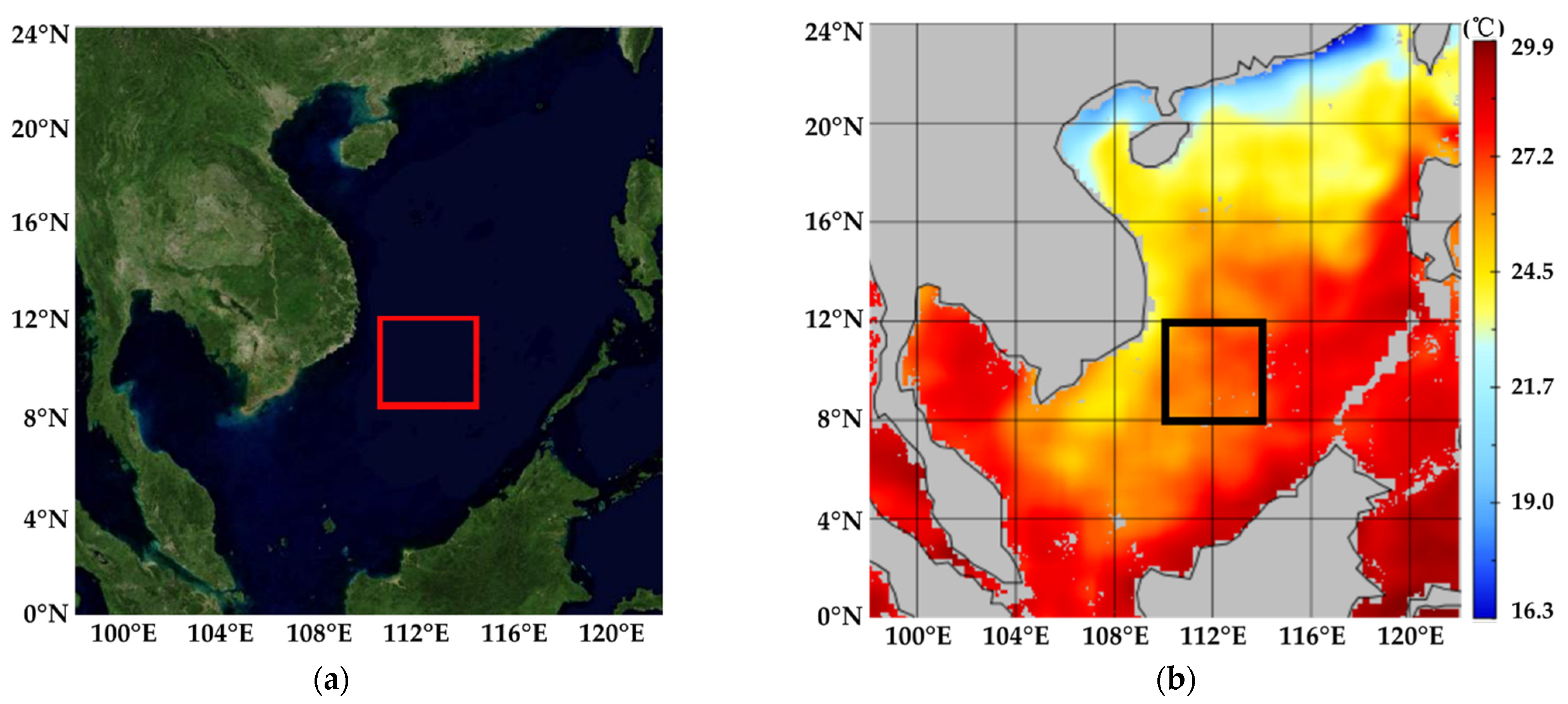

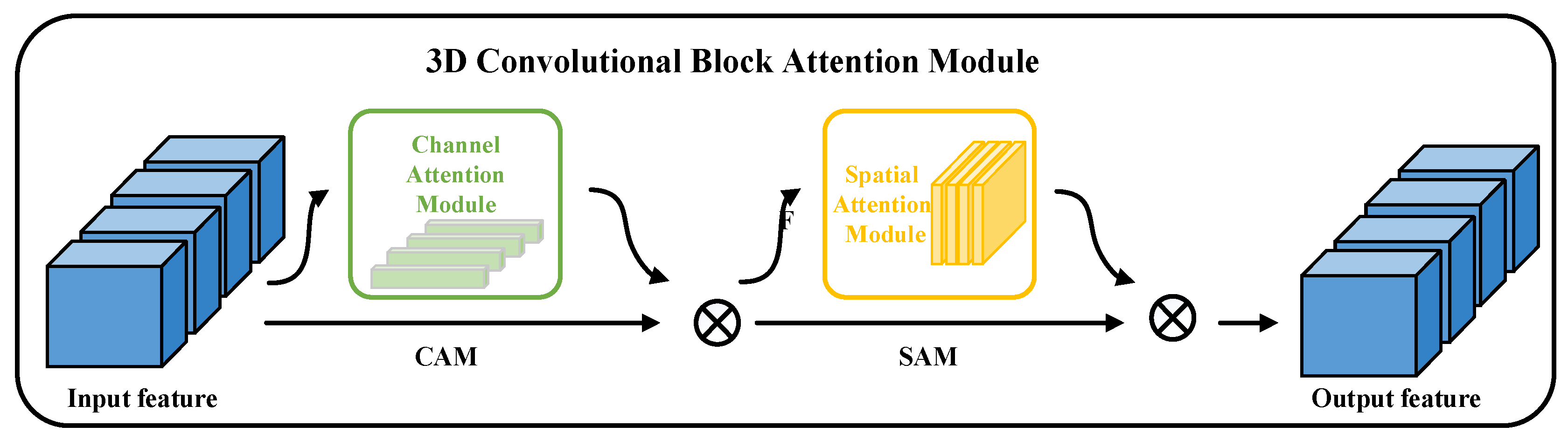

Remote Sensing Free Full Text A Hybrid Deep Learning Model For The Bias Correction Of Sst Numerical Forecast Products Using Satellite Data Html

Malaysia Is Your Ultimate Business Destination Eco Business Park V

Pdf The Status Of The Paddy And Rice Industry In Malaysia

Remote Sensing Free Full Text A Hybrid Deep Learning Model For The Bias Correction Of Sst Numerical Forecast Products Using Satellite Data Html

Malaysia Company Incorporation Faqs 3e Accounting

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

International Shipping From Singapore To Malaysia Cost How It Works

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

1 Key Policy Insights Oecd Economic Surveys Malaysia 2021 Oecd Ilibrary

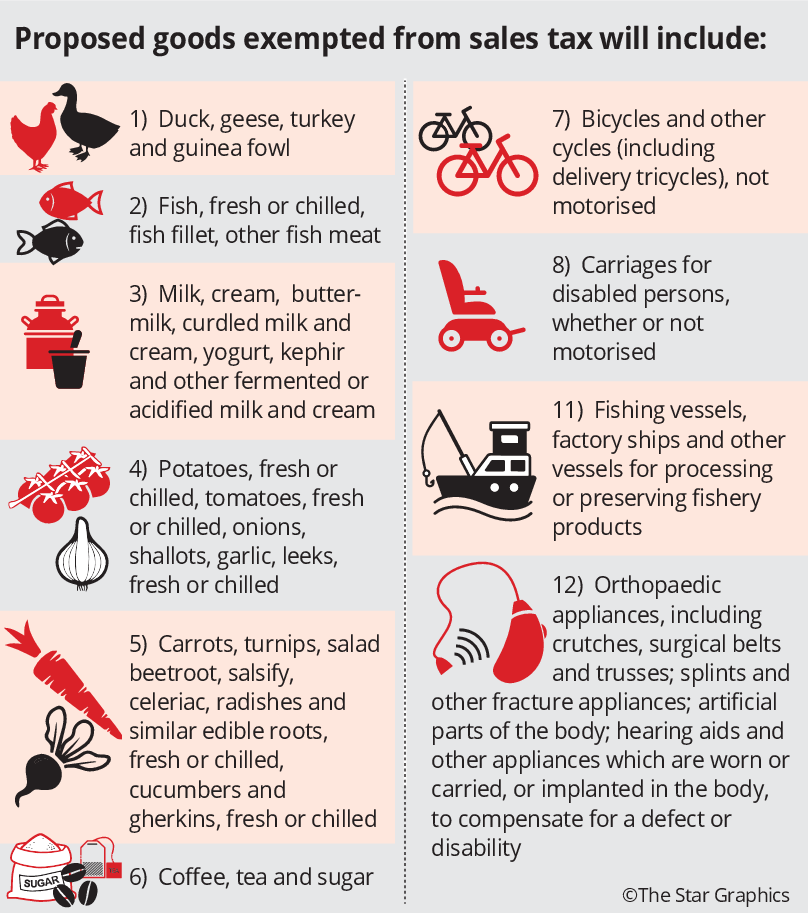

Essential Items Will Be Exempted From Sst

Remote Sensing Free Full Text A Hybrid Deep Learning Model For The Bias Correction Of Sst Numerical Forecast Products Using Satellite Data Html